Specialist Services

The extensive collective experience of the Rawlinsons team means that we can offer our clients a range of additional services to guide them through the construction process with confidence and peace of mind.

Engineer to the Contract

Professional contractual advice

Appointment of an Engineer to the Contract (now split into two roles: Contract Administrator and Independent Certifier) is a requirement of the most common forms of engineering contracts (NZS 3910 and 3916) used in New Zealand, and Rawlinsons has several experts capable of performing the functions these contracts require. Primarily these are 1/ to act on behalf of the client regarding contractual matters, and 2/ to independently arbitrate disputes between the client and their contractor.

Until 2023, both functions were carried out by an Engineer to the Contract (a named individual). Following changes to regulation in 2023, these functions have been split into two separate roles: Contract Administrator and Independent Certifier.

The Engineer to the Contract/Contract Administrator acts for the client (the ‘principal’) on contractual matters; for example, ascertaining if requested progress payments accurately represent the actual work completed and billed by the contractor.

The Engineer to the Contract/Independent Certifier acts objectively and independently of both parties when considering proposed variations to timeframe or cost, or in instances of dispute.

These roles require an understanding of contract law, as well as significant practical experience as a Quantity Surveyor. Several members of the Rawlinsons team have this combined skillset.

Engineer to the Contract

Roles Split

Contract Administrator & Independent Certifier

Bank Funding Reporting

Monitoring spend to minimise spending risk

When a bank lends money to a client to undertake a project, a condition of loan may be that the client provides independent financial reporting related to the spend associated with that loan.

Rawlinsons has provided this reporting on projects with budgets ranging from $0.5 million to $85 million.

We not only provide information on draw-down and fund allocation, but cast a critical eye over the project, identifying potential issues early on so that there are no surprises for either the client or the bank regarding proposed budget and costs.

Building Information Modelling (BIM)

Maximising cost certainty with advanced technology

BIM is an advanced technology that extracts detailed information from drawings, plans, data schedules or other files and uses it to create comprehensive 3D models of the intended project.

Our experienced Quantity Surveyors review, interrogate and check the data contained in these models, making sure that every element required for construction through to completion is included, and accurately quantified and costed.

When a change is made e.g. a window size is changed, the model automatically updates and the changes ripple out through all related construction documentation and schedules, as well as the cost estimate.

Because BIM provides centrally held information that updates in real time, it minimises the risk of discrepancies between the multiple services involved in a project.

Rawlinsons was one of first companies in New Zealand to invest in and use this state-of-the-art technology, providing us with an ongoing and evolving catalogue of information to support planning and accurate cost estimating for future projects.

Quantitative Risk Analysis

Mitigation and contingency planning

Every build project faces risk, but Rawlinsons helps you to identify, mitigate and manage risk, especially where it can impact your bottom line.

Risk management typically involves:

- identifying risks;

- performing qualitative (subjective) risk analysis (estimating likelihood and impact of occurrence);

- performing quantitative (statistical) risk analysis; and

- planning responses to control or mitigate those risks.

Quantitative Risk Analysis (QRA) involves calculating and assigning dollar values to identified risks and then developing strategies to mitigate negative financial impacts occurring. This makes it an essential planning component, and one which can help avoid blowouts of budgets or timeframes.

Good analysis and risk forecasting relies on a comprehensive understanding of variables and good-quality evidential data. Rawlinsons can facilitate a thorough analysis process by leading a project-specific workshop in which all parties use their expertise to identify project risks. Using this information, the data we have compiled from the wide range of infrastructure and build projects we have undertaken and our forecasting tools, we can undertake comprehensive QRA.

This analysis of feasibility and budget impacts will include advice on realistic and practical strategies to mitigate potential risks, and planning for cost and time contingencies.

We can also provide reports and updates as to how those risks (and their likelihood) track through the life of the project.

Identify risks

Perform qualitative risk analysis

Perform quantitative risk analysis

Plan risk responses

Implement mitigation measures

Review and update throughout project

Whole Life Cost & Building Life Cycle Assessment

Prepare and plan for the future

The cost of occupying a building over an average 25-year lifespan can be as much as 10 times its capital cost. Cost of occupation is therefore a vital consideration for any owner or occupier, as these costs need to be factored into long-term operation, maintenance and repair.

Life Cycle Costing (LCC) is therefore becoming increasingly essential, especially in relation to public-use buildings which require public funds for operation and maintenance.

The benefits of considering LCC include:

- encouraging a considered and realistic analysis of business needs;

- factoring in ability to optimise the total cost of ownership/occupation, rather than just considering initial capital and running costs;

- understanding the impact of current decisions on longevity, use and maintenance;

- promoting realistic budgeting for use and operation;

- capturing data on actual performance and operation, compared to estimated or predicted data.

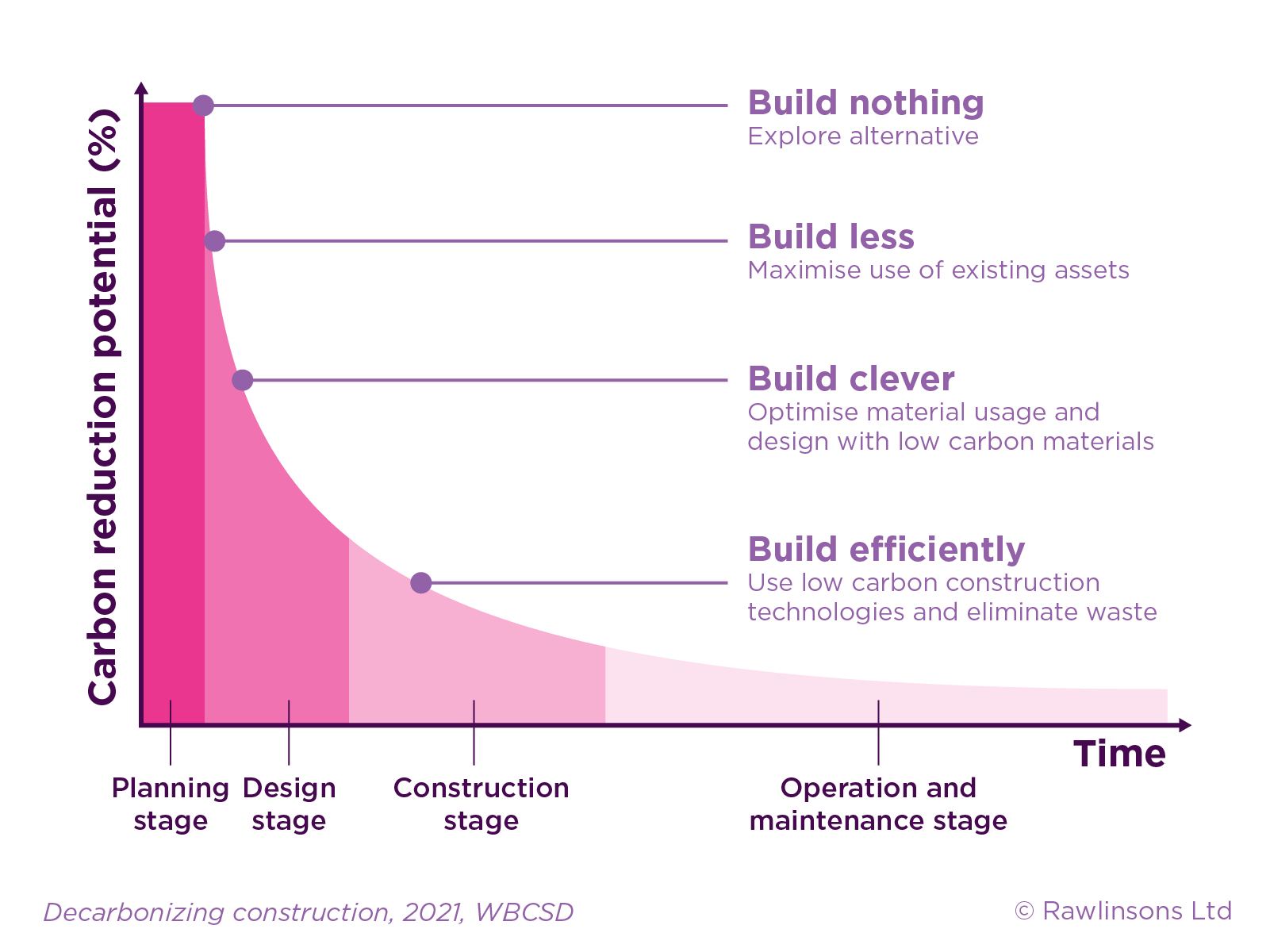

Expanding beyond Life Cycle Costing is Whole Life Costing (WLC), which considers social and environmental impacts and costs, in addition to economic ones. WLC answers a growing demand for better understanding of the indirect costs of construction associated with environmental impact. For example, the extraction, manufacture, transportation, building and eventual decommissioning (including possible reuse or recycling) of construction contributes 11% of all carbon dioxide emissions globally. Operational emissions during a building’s lifetime average another 28%.

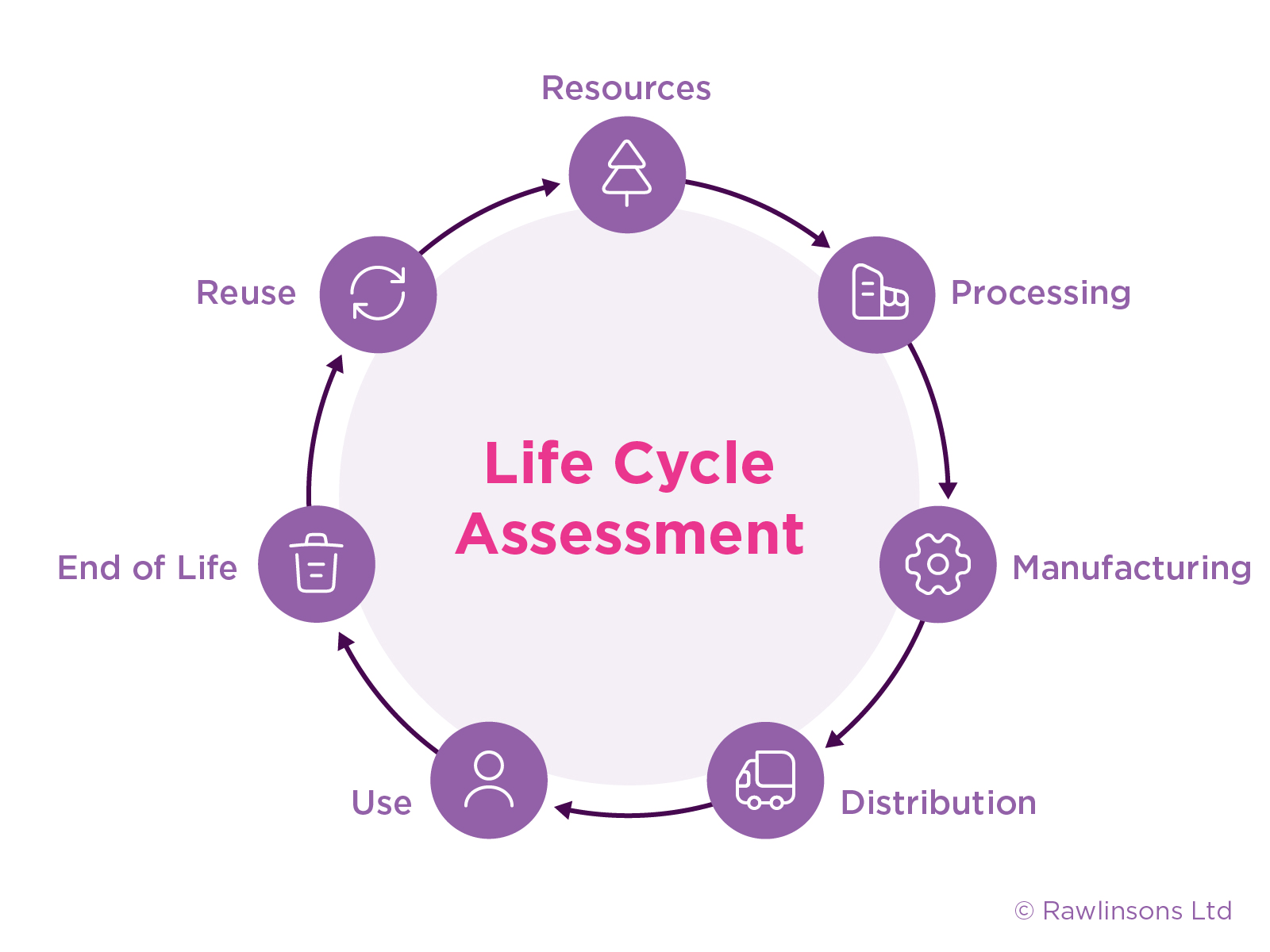

The Building Life Cycle Assessment (LCA) is the scientifically calculated environmental impact of a building throughout its entire existence. Undertaking Building LCA as part of your Life Cycle Costing helps to identify potential areas of concern, assess likely negative impacts and explore alternatives to maximise positive impact.

The benefits of LCA are many and include: achieving a sustainability certification (e.g. Green Star); adhering to government requirements; meeting investor expectations; and demonstrating responsible global citizenship.

Rawlinsons has an in-depth understanding of all aspects of lifecycle costing, and can help you effectively plan and optimise your asset’s future.

Insurance Valuation

Value your investment correctly

Construction and infrastructure projects require significant investments of time, resource and energy. To ensure that your investment is protected, appropriate insurance is essential.

Under- or over-estimates will cost you, either through excessive present-day premiums or unforeseen future rebuild costs.

To avoid both possibilities, you need accurate estimates of the replacement or repair of your building; as construction cost consultants, that is the essence of what Rawlinsons do every day.

Rawlinsons can see beyond the obvious because we understand all the variables required in any rebuild or significant repair – demolition, site clearance, design fees, inflation, consenting authorities’ approvals, and much more. We routinely work across every stage of a construction project, from conception through to sign-off, and know what input will be required from every stakeholder.

Where a property valuer will advise you on property value, we can advise you on cost, inclusive of the smallest detail, delivering you an accurate estimate of replacing your building that will help protect your current investment well into the future.

Peer Review Services

Independent oversight

Construction projects are complex. Peer review processes help confirm best practice is being adhered to, delivering accuracy, risk mitigation, safety and compliance.

The benefits of external peer review include trust that due diligence has been undertaken without bias, and that your project is in the best position possible to meet its goals, timeline and budget. This objective and external oversight can therefore help provide confidence and practical endorsement to external stakeholders such as investors, consenting authorities and the communities within which your project will operate.

Rawlinsons’ senior staff members are experts in their respective fields and are recognised as such within New Zealand. With years of practical experience and technical knowledge, they are qualified to offer objective and meaningful feedback on complex construction projects, spotting concerns, inconsistencies or opportunities for enhancement.

Public – Private Partnerships & Market-Led Proposals

Shared investment for maximum benefit

Public-Private Partnerships (PPPs) and Private Finance Initiatives (PFI) are Government procurement strategies that originated in the 1990s.

They involve private investment into public works. The private sector undertakes design, financing, construction, and operational risks in exchange for long-term returns. By doing so they enable the public sector to deliver essential services without committing significant, immediate financial investment.

PPPs and PFIs have frequently resulted in more rapid project completion due to streamlined decision-making and reduced red tape, and (often) deliver a better adherence to budget and timeline. Although profit may devolve to the private sector, so does risk, and maintenance costs can be more easily planned and accommodated in long-term public budget planning.

However, in the past these contracts were often complex, didn’t allow for adaptation or modification as the political, regulatory or financial environment changed, and sometimes still came with financial downsides for the public purse due to lack of comprehensive Life Cycle Costing.

When entering into a PPP it is important to understand the opportunities, and also the complexities. Rawlinsons’ extensive understanding of procurement options means that we can advise clients and/or contractors on how to obtain (and offer) best value during the PPP process.

Market-Led Proposals – PPP for New Zealand

Market-Led Proposals (MLP) represent an evolution of the Public-Private Partnership concept designed to encourage private enterprise for public benefit in New Zealand.

The private sector can approach the New Zealand Government for public funding to undertake a project that will deliver a viable solution and/or provide other benefits to the New Zealand public, while also coinciding with Government priorities.

How they work

To be considered under the current 2024 MLP guidelines, project proposals must:

- be in the Public Interest (align with Government policies and priorities and the National Infrastructure Plan; feature appropriate accountability and transparency; offer public access and equity; and protect consumer rights and security);

- provide Value for Money (quantitative aspects include the Benefit Cost Ratio (BCR); Government’s budget requirements; the Proponent’s expected ROI, and other key assumptions used in the proponent’s financial model. Qualitatively, the assessment includes the combination of scope, risk allocation and time to complete); and

- represent Exclusivity (i.e. the proponent must be the only party who can provide this solution because they offer intellectual property or genuinely innovative ideas; own exclusive property rights otherwise unavailable to Government; own software or technology offering a unique benefit; present unique contractual arrangements that cannot be offered by others; and/or bring value for money that cannot be matched by the market).

Detailed guidelines and processes are now available to assist proponents of new projects to consider if they meet the MLP benchmarks and, if so, how best to prepare their approach to the Government to begin the assessment process.

MLP is relatively new to New Zealand, and requires adherence to multiple policies and requirements. Rawlinsons can advise clients and contractors on considerations to maximise the success of proposals, and the possible partnerships that may ensue.